INTEREST RATES, EXPLAINED

- By

- Kindred Homes

- Posted:

- September, 21, 2023

- Categories:

- General

While most buyers understand that rates are an essential part of the home buying process, many don't fully comprehend their impact on their home purchases. Currently, rates are at historically low levels, making now a great time to purchase your dream home.

Here are a few tips to help better understand the importance of interest rates and how they can impact your home purchase.

Low-Interest Rates Increase Buying Power

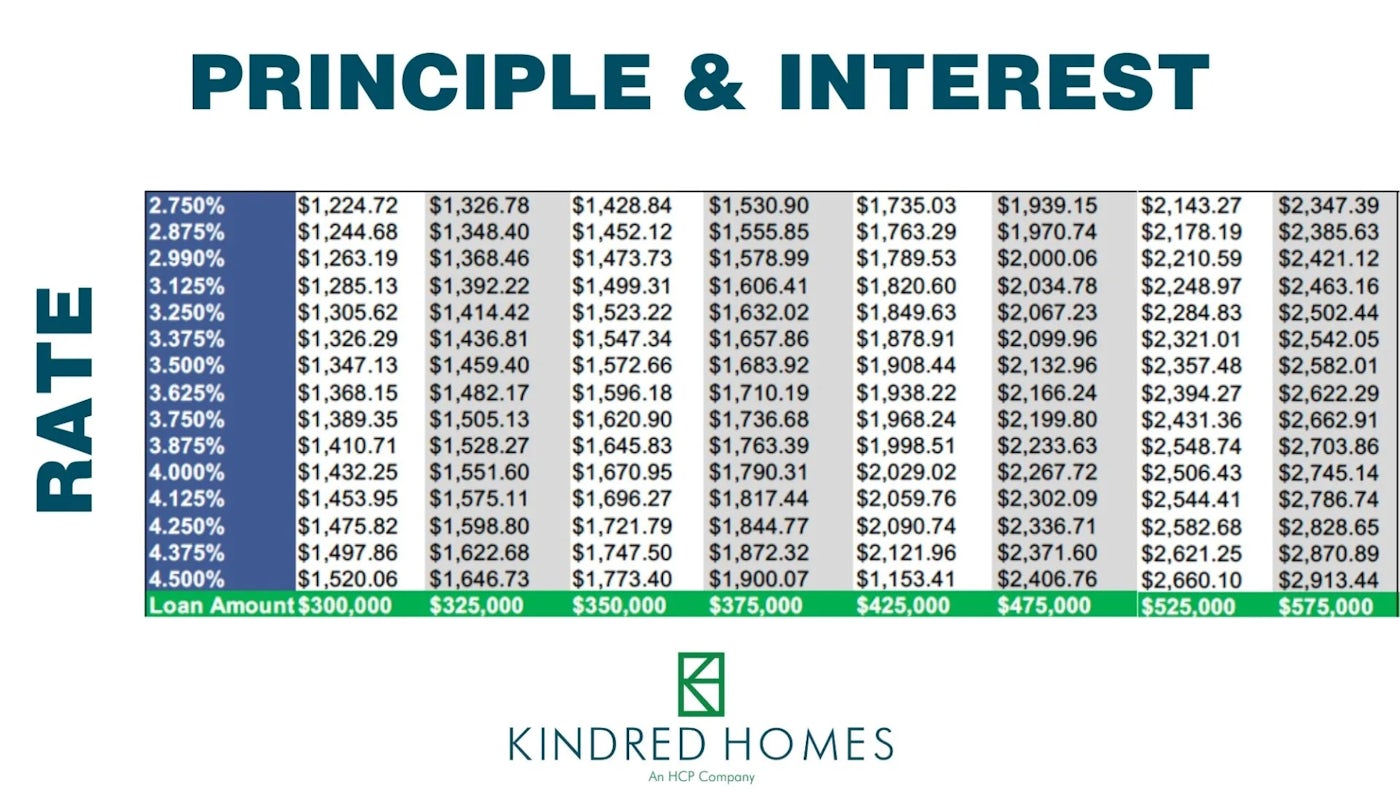

With low rates, a buyer's purchasing power increases because the percentage of the payment going towards interest is less, meaning more of the monthly payment goes to the purchase price. Additionally, lower rates open the door to buyers who otherwise couldn't afford a home at the current market prices. The difference between a 3.5% and 4.5% interest rate is significant because the difference in monthly payments for the same loan amount can determine whether a home is affordable to the buyer.

Don't Delay Locking in Your Rate

If you are looking to buy a home, locking in low rates can be essential. Rates can fluctuate, and if they increase while you wait, the monthly price of the home you love could also increase.

If you can obtain a loan at a 3.5% rate now, with a monthly payment of $1,908, but decide to wait a year to purchase, your new monthly payment could go up several hundred dollars if the interest rate increases to 4% or 5%.

When you wait to lock in a low rate, what you once could afford might become out of reach, and you could find yourself settling for a less desirable home or needing to delay your home buying decision even longer.